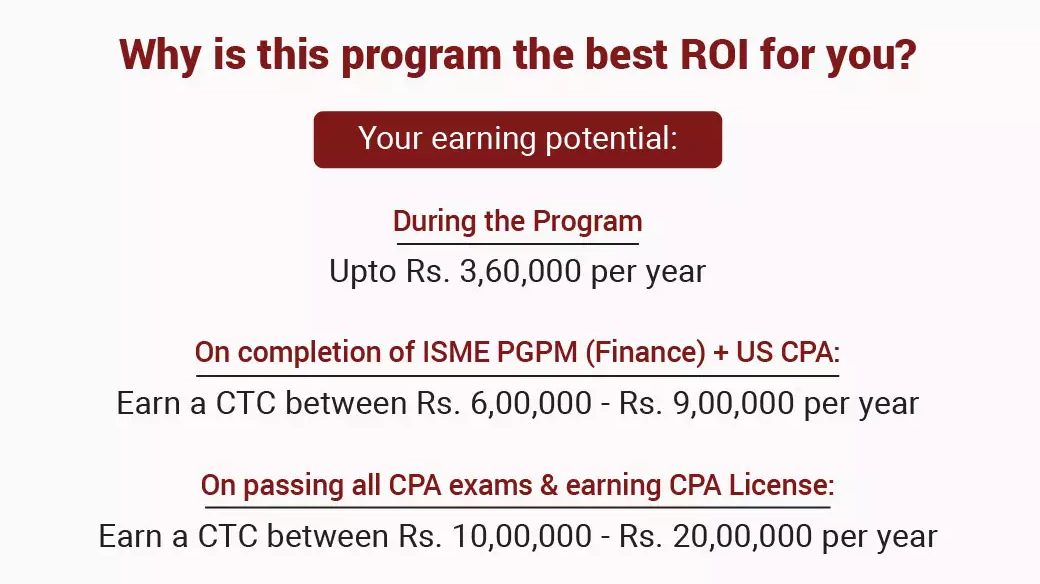

Work on Weekdays + Learn on Weekends + Be a CPA in 2 Years

Paid Internships with MNCs like Ernst & Young, Grant Thornton, KPMG, PWC & Deloitte

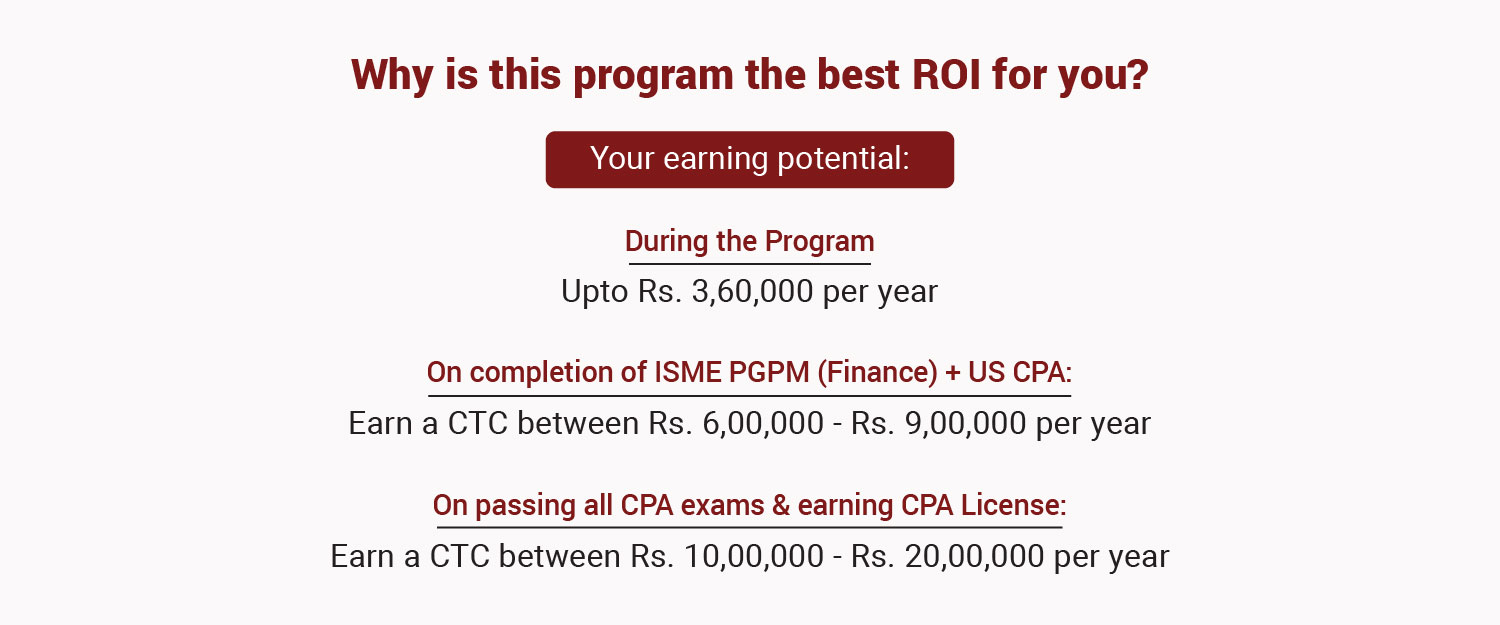

Earn upto Rs. 30,000 per month during the course duration

Explore our One-year US CPA Program – CLICK HERE

Avail flexible monthly fee payment options & scholarships. Click Here

DURATION

2 Years

500+ Live Online Classes

6-8 Hours Weekend Classes per week

12 Months of Paid Internships during Weekdays with MNCs like Ernst & Young, Grant Thornton, KPMG, PWC & Deloitte

PROGRAMME FEE

INR 3,90,000/-

Fee includes Full Access to Beckers’ Reviews Material

Paid Internship (Upto Rs. 30,000 per month) and Final Placement

Full support for US CPA evaluation & licensing process

ELIGIBILITY

Graduate / Post-graduate in Commerce / Accounting and/or CA / CMA / CS / ACCA with minimum 60 percent in 10th,12th and Graduation.

Age – 25 years and below

Learn from the expert leaders & accomplished practitioners from the industry. Click Here

PROGRAM HIGHLIGHTS

With the convergence of global accounting practices and emergence of technology-based accounting practices, today, the demand for accounting professionals with skills to audit, analyse and manage international financial reporting and investor relations are at their peak than never in the history. The presence of literally every transnational corporation in US, as well as two-thirds of large corporations of the globe headquartered in US, the accounting processes are also focused accordingly.

The ISME PGPM (Finance) + US CPA is uniquely designed to prepare a full-fledged accounting professional with (1) Knowledge of International Accounting Practices (2) Technical Skills for Accounting Processes and (3) Managerial Skills.

The programme is designed and scheduled such that the student is able to complete his US CPA certification and required management courses, while student is also earning a full 12-month experience of working with big audit firms like E&Y, GT, PWC, Deloitte and KPMG. Placed as interns in these companies, students get to learn the accounting and audit practice hands-on while also earning a monthly salary of upto Rs. 30,000 as intern during these 12 months.

Professionally planned coaching through Beckers’ Premium Reveiw Materials

Live Online Classes from CPA Certified Faculty working in Big Accounting Firms & Investment Banks

Structured, rigorous & planned approach to help you be a Certified CPA

Start-to-end CPA Licensing Support

Assured 12-month paid internship (upto Rs.30,000 per month) with Global MNC Accounting & Audit Firms

ISME has been successfully placing students since its inception and ISME alumni are working with various financial, accounting and audit firms, Ernst & Young, Delloitte, Grant Thronton, PWC and KPMG, to name a few. At the end of the program, student is assured of being placed by ISME with well-known multinational accounting & audit firms. The career opportunities to pursue international jobs also enhance with the US CPA program.

KEY PROGRAMME TAKEAWAYS

|

|---|

| 100% Preparation for all 4 CPA exams & CPA Licensing |

|

|---|

| Internship Salary of upto Rs. 30,000 per month |

|

|---|

| Managerial & Leadership Skills for an International Management Career in Finance |

|

|---|

| Case Studies & Live Projects to upskill the Classroom Learning |

|

|---|

| Workshops on Finance, FinTech & Accounting and Financial Analytics |

CPA is the highest accounting credential worldwide. The US CPA designation ensures international recognition for finance and accounting professionals. The US CPAs are in demand across various companies and industries. Typically, most organizations need CPAs and auditors. Besides, most of the CPAs work as business consultants and tax professionals. Their expertise in finance and accounting leads to attaining high salaries. According to AICPA’s survey, the CPA fresher salary in the US is $66,000 per annum. The average salary for a CPA in the US is $119,000, with 20 years of experience, one could command more than $160,000 annual pay.

Career Choices for CPAs:

- Risk and Compliance Professional

- Senior Financial Analyst

- Accounting Software Developer

- Corporate Controller

- Personal Financial Advisor

- Information technology Accountant

- Finance Director

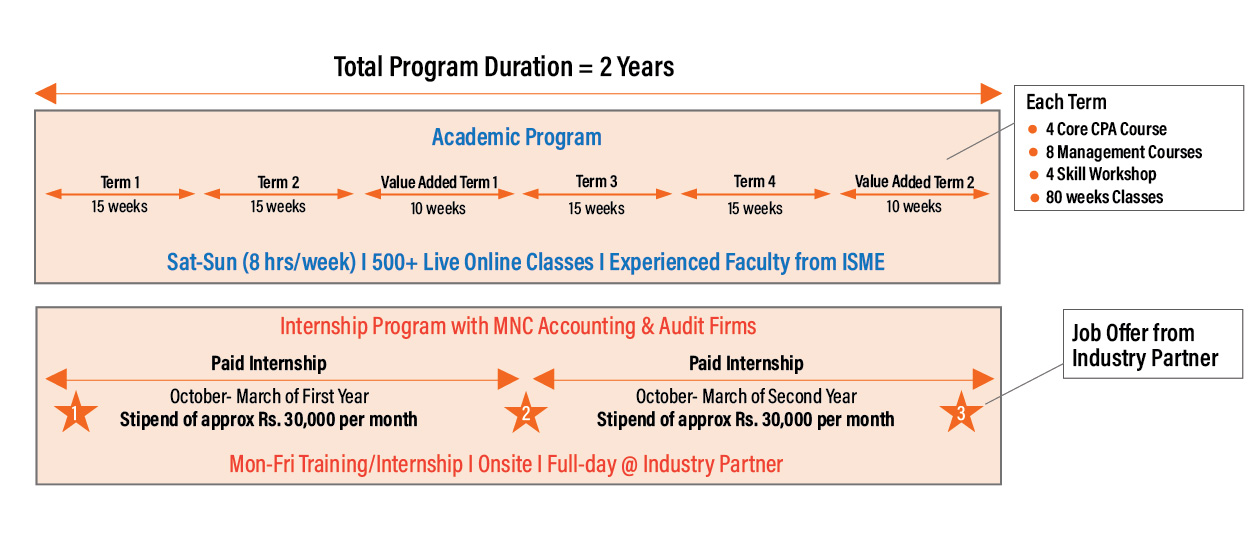

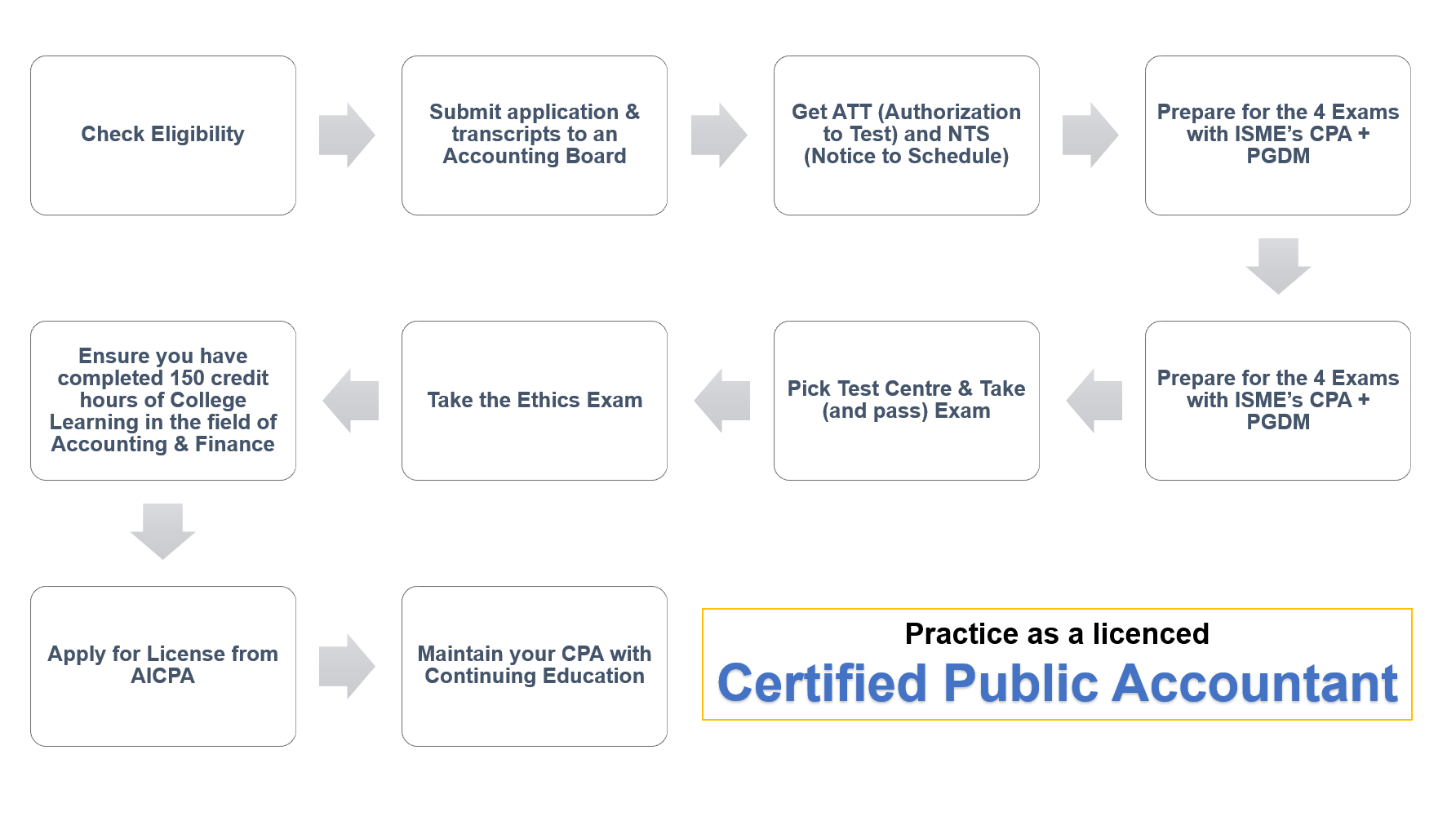

Roadmap to US CPA

You will also be certified by our CPA faculty for CPA Licensing for meeting your work experience requirement of US State Accounting Boards

You will also be certified by our CPA faculty for CPA Licensing for meeting your work experience requirement of US State Accounting Boards

Steps to Become US CPA

- Check Eligibility

- Submit application & transcripts to an Accounting Board

- Get ATT (Authorization to Test) and NTS (Notice to Schedule)

- Prepare for the 4 Exams with ISME’s CPA + PGDM

- Prepare for the 4 Exams with ISME’s CPA + PGDM

- Pick Test Centre & Take (and pass) Exam

- Take the Ethics Exam

- Ensure you have completed 150 credit hours of College Learning in the field of Accounting & Finance

- Apply for License from AICPA

- Maintain your CPA with Continuing Education

Eligibility to apply for ISME PGPM (Finance) + US CPA:

Graduate / Post-graduate in Commerce / Accounting and/or CA / CMA / CS / ACCA

Eligibility to apply for CPA License:

CPA license is issued by the 55 state boards of accountancy of the US that are part of NASBA. Each state board has different eligibility criteria that the aspirant needs to meet to take the US CPA exams.

- Master’s Degree in any of the streams of Commerce, Accounting or Finance

- An aspirant needs 120 credits to take the US CPA exams and 150 credits to get his CPA license

- It’s considered that one year of university education in India is equal to 30 credits of US education

- In some cases, first division graduates of a three-year degree from NAAC-A accredited universities of India are qualified to take the US CPA exams too.

Selection Process:

Stage 1: Complete Application Form (Online)

Every applicant seeking admission to ISME needs to complete the Application Form (https://admission.isme.in/pg)

Stage 2: Interview with ISME subject to meeting eligibility (Online/ Face to face)

Stage 3: Admission Letter from ISME on selection

Based on the review of the application, and the recommendation of the interview panel, the admission committee invites selected students for admission to the program. Admitted candidates are sent the Admission Offer letter. The admission would be final only after the receipt of confirmation of Admission Acceptance form from the candidate and the payment of the registration fee.

Stage 4: Payment of Admission Fee @ISME* (https://staging.isme.in/admissions/fees)

Stage 5: Selection Process by Internship Company

Internship company may conduct a personal interview, written test or any other form of selection process as per the company practice.

Stage 6: Offer Letter by Internship Company

Once the candidature is accepted by the internship company, an offer letter is issued.

Note: In the event if student do not get selected by the internship company Rs 45000 will be refunded, Rs 5000 will be deducted as processing fee.

Term – 1

VA Term 1

VA Term 2

Term – 2

Term – 3

VA Term 1

VA Term 2

Term – 4

15 Weeks | 144 Online Live Sessions on Weekends

- US CPA Subject: Financial Accounting & Reporting (FAR)

- Skill Workshop: One-day Immersive Workshop – “Advanced Excel for Accounting & Audit Professionals”

15 Weeks | 144 Online Live Sessions on Weekends

- US CPA Subject: Auditing and Attestation (AUD)

- Skill Workshop: One-day Immersive Workshop – “Report Writing & Formal Written Communication”

15 Weeks | 144 Online Live Sessions on Weekends

- US CPA Subject: Regulation (REG)

- Skill Workshop: One-day Immersive Workshop – “Emerging Accounting ERP Systems”

15 Weeks | 144 Online Live Sessions on Weekends

- US CPA Subject: Business Environment & Concepts (BEC)

- Skill Workshop: One-day Immersive Workshop – “FinTech & Financial Analytics”

VA Term 1: Industry Internship

VA Term 2 : Marketing Management Organizational Behavior and Human Resource Management Managerial and Professional Skills 1

VA Term 1: Industry Internship

VA Term 2 : Operations Management Basic Statistics Managerial and Professional Skills 2

Term – 1

- Economic Decisions for Decision Making

- Quantitative Methods for Management

- Managing People & Organisations

- Business Analytics & Advanced Excel

Term – 2

- Marketing Management

- Applied Financial Management

- Project Management

- FinTech & RegTech

Term – 3

- Financial Accounting and Reporting (FAR)

Term – 4

- Regulation (REG)

Term – 5

- Business Environment and Concepts (BEC)

Term – 6

- Auditing and Attestation (AUD)

Term – 7

- Accounting & Financial Analytics

- Security Analysis & Portfolio Management

- Derivatives & Alternative Investments

- Multinational Financial Management

- Structured rigour in the program

- Weekend Classes (Saturday & Sunday)

- 6- 8 hours on the weekend

- CPA Certified Industry Practitioners & Faculty from USA

- Self-paced learning content by Becker Professional Education

- Value-added Skill Enhancement Workshops

- 500+ Live classes

- 24*7 access to online program material

- Access to 240+ hours of exclusive recordings

- 6500 Multiple Choice Questions

- 250 task-based simulations and study planner

- Access to mock exams

- One-on-one discussion with Expert Mentors

Schedules customised for Financial Year Ending Load

No Classes during Jan-March Period

Prasad Dhulipalla, CPA, Grand Thronton, Ex-EY

Kiran Agarwal, CA, CPA, NetApp, Ex-KPMG

Swetha V, CPA

Prasad Dhulipalla, CPA, Grand Thronton, Ex-EY

Kiran Agarwal, CA, CPA, NetApp, Ex-KPMG

Swetha V, CPA

Highly Experienced Faculty comprising of CPA Practitioners, Industry Leaders, International Scholars & Accomplished Academicians

Our CPA faculty are practising experts with major accounting firms & Big4 Audit firms

Know your Faculty

Highly Experienced Faculty

DR. RAJA SANKARAN

PhD (Marketing) IIM-Ranchi, MBA, B.Sc. (Electronics)

Has held senior management positions with multi-national companies in a service delivery role before moving to academics. Has published research papers in ABDC category A journals.

On successful completion of 18 month, you would earn:

- Certificate of Post Graduate Program in Management (Finance)

- US CPA License (Subject to passing all 4 AICPA exams & meeting all AICPA/NASBA/State Board Requirements for Licensing)

- ISME Alumni Status